Chicago Transit’s fiscal issues didn’t emerge in a single year and should serve as a warning for many other transit systems throughout the United States. In 2026, Chicago’s transit network, the veins and arteries of the nation’s third-largest metropolitan economy, will face its most severe financial test in decades. The Regional Transportation Authority (RTA), which oversees the Chicago Transit Authority (CTA), Metra, and Pace Suburban Bus, warns of a looming “fiscal cliff” that could open a $730 million hole in the system’s annual budget. Without decisive action, the region risks a wave of service cuts and fare increases that could go far beyond transit riders, potentially shaping real estate markets, labor mobility, and even the city’s competitive economic position.

For municipal debt investors, this is not simply a public sector budget story. It’s a case study in post-pandemic revenue volatility, a critical need to develop a reliable Long Range Financial Plan (LRFP) for transit agencies in the United States, infrastructure investments, and understanding the risk of an undiversified revenue source for transit agencies. In this article, we will take a closer look at what led to Chicago’s transit system’s current state.

How Did it Get Here

Before the pandemic, RTA’s revenue mix followed a relatively stable pattern. A blend of farebox income, local sales tax allocations, and targeted state and federal grants kept the system balanced, though not without its structural pressures. During COVID-19, the fare revenues fell due to the sudden ridership decline on the transit system, resulting in millions of dollars in fare revenue loss – very similar to many other transit systems throughout the US.

During this time, federal emergency relief, nearly $3.4 billion for the RTA region, was provided as the lifeline. That money has been the glue holding the operating budgets together from FY2021 through FY2025. But it was never designed to last forever. In the financial projections below, the RTA projects that by 2026, these federal funds will be thoroughly exhausted. The operating budget, however, will still reflect the “new normal” of ridership: only about 70% of pre-pandemic levels in 2024, with no guarantee of a complete rebound. This is the essence of the fiscal cliff—a sudden drop in available funding, with no built-in mechanism to replace it.

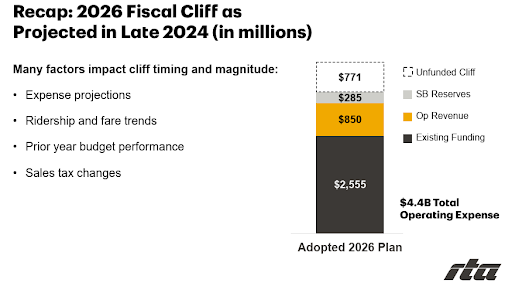

In the recent presentation to the RTA board, staff put forward a dire condition of the agency, highlighting the unfunded expenditure for $770 million – this is assuming all the future revenues materialize in line with the projections.

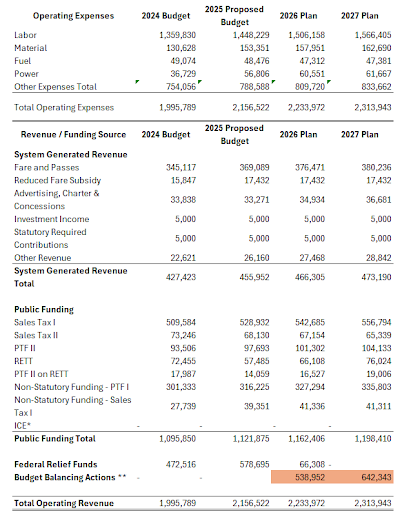

As we review the FY2025 Proposed Budget for Chicago Transit, in addition to the federal funding going away in FY2026, several other key factors stand out—each of which, if not managed carefully, will push the agency toward a fiscal cliff.

The FY2025 budget was balanced at approximately $2.2 billion, funded through a combination of system-generated revenue, sales tax receipts, and federal support.

Source: Regional Transportation Authority Adopted FY2025 Budget

Why the Gap Is So Large

In their recently proposed FY2026 budget, the projected $730 million shortfall isn’t merely about the disappearance of federal dollars. It’s about the interaction between long-term cost trends and slow revenue recovery.

On the cost side, labor contracts, fuel and energy expenses, insurance, and pension obligations continue to grow at a steady clip. These are not costs that can be slashed quickly without undermining service quality or capacity. Here are some of the key concern areas looking at the financial statements above:

- Labor costs account for nearly 70% of total expenditures. This means that any changes to wages, particularly through union negotiations, can have a multi-million-dollar impact. It’s important to note that revenue streams are volatile, while expenditures generally increase year over year, regardless of revenue fluctuations. This disconnect can result in unplanned budget deficits reaching tens of millions of dollars.

- The agency is heavily dependent on sales tax revenues and state-level funding, both of which are tied to consumer and business spending. During economic downturns or periods of weak consumer activity, sales tax collections decline, often triggering state budget cuts, including public transit funding. For Chicago’s transit system, the state funds are received through the Public Transportation Fund (PTF, which supports the ongoing operational costs of the agency.

- Finally, starting in FY2026, we see the phase-out of federal relief funds, which have played a critical role in stabilizing the budget in recent years. The loss of this support alone could create a funding gap of nearly half a billion dollars. It’s also highlighted in the financial chart above.

The Impacts of the Fiscal Cliff on the Regional Economy

For an investor, the fiscal cliff isn’t just a balance sheet issue – it’s a systemic risk as described above.

According to the RTA’s website, Chicago’s transit system is a productivity multiplier. It enables millions of workers to access jobs without the congestion and environmental costs of car commuting. It supports tourism, retail activity, and large-scale events. It connects regional labor markets, making it easier for employers to find talent and for workers to access opportunity.

The potential consequences of deep service cuts:

- Reduced labor mobility leading to hiring challenges and slower job growth.

- Increased congestion, which could dampen productivity and raise business costs.

- Negative real estate impacts, particularly for transit-oriented developments whose value depends on frequent, reliable service.

- Equity setbacks, as low-income residents and transit-dependent households would face reduced access to work, school, and healthcare.

These effects compound over time, meaning the cost of inaction isn’t just the size of the budget gap—it’s the GDP drag that accumulates if service quality declines.

What Can Other Transit Agencies Learn From RTA?

The RTA’s predicament offers several broader insights; firstly, reliance on a narrow revenue base is a vulnerability.

- Transit’s heavy dependence on farebox recovery and a single form of tax (sales tax) mirrors concentration risk in an investment portfolio.

- Furthermore, temporary relief funds can mask structural deficits. Federal aid kept the system afloat, but it also delayed the reckoning. This mirrors corporate finance cases where bridge financing defers, rather than solves, underlying cash flow issues.

- In addition, public goods have compounded ROI. Like infrastructure or education, transit delivers returns over decades. Cutting investment now to balance the books can create negative multipliers later—higher congestion costs, weaker labor participation, and diminished urban competitiveness.

- Most importantly, implementing a Long Range Financial Plan to understand the future fiscal health of the agency and plan for any budgetary challenges well in advance

For those tracking this from a finance or investment perspective, several key indicators may need to be watched: recovery rates compared to budget assumptions; State legislative proposals for dedicated transit funding; Local economic performance, especially retail sales tax collections; Labor cost trends, including upcoming union negotiations; Credit ratings for CTA, Metra, Pace, and the RTA itself—any downgrade could raise borrowing costs for capital projects.

The Bottom Line

The Chicago region’s transit fiscal cliff is more than a public agency’s budget problem—it’s a regional economic challenge with implications for labor markets, business competitiveness, and urban development. The $730 million gap projected for FY2026 is large. Still, it’s also a policy problem that can be solved with the right mix of cost-cutting measures, funding diversification, service innovation, and political will. This also underscores the need for a long-range financial plan for all transit agencies throughout the US and acting early and swiftly to ward off any potential future fiscal challenges.

Suppose the region can bridge the fiscal gap without sacrificing service quality. In that case, it will preserve one of its most important assets—and, in doing so, safeguard the economic engine that benefits all.